2019 ERAI Reported Parts Statistics

Damir Akhoundov

ERAI INSIGHT

2019 ERAI Reported Parts Statistics

By: Damir Akhoundov

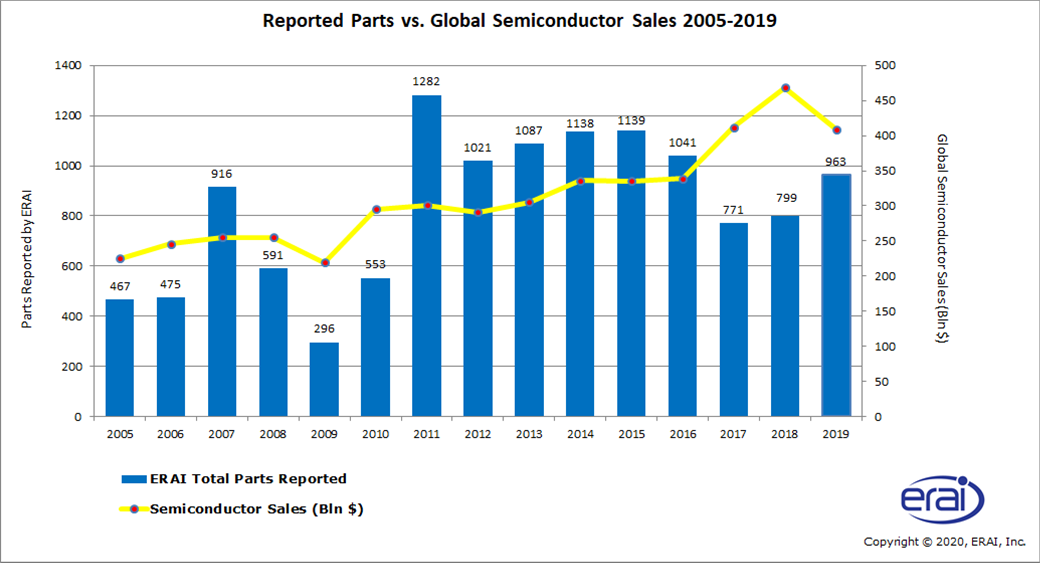

The Semiconductor Industry Association (SIA), representing U.S. companies involved in semiconductor manufacturing, design, and research, announced that the global semiconductor industry posted sales totaling $412.1 billion in 2019, a decrease of 12.1 percent compared to the 2018 total of $477.9 billion unlike the past 2 previous years’ growth trend. The number of nonconforming parts reported to ERAI in 2019 increased 18% in comparison to the previous year. After following the semiconductor sales trend closely for 12 years, we can observe that for the last 3 years, the correlation seems to have been inverted.

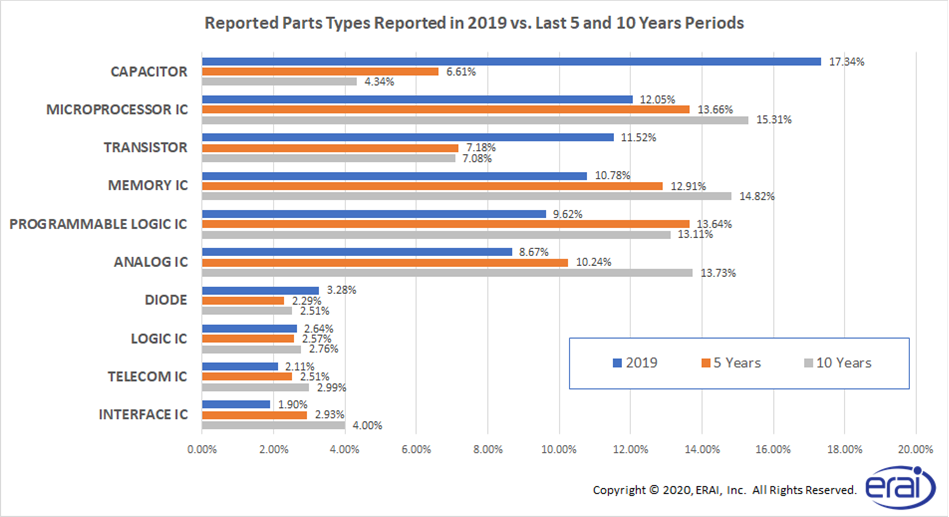

The types of electronic parts reported in 2019 also varied from the general set of parts reported over the last 10 years. Below you can see the combined graphs of the types of parts reported in 2019 versus those reported over the last 5 and 10 years respectively. We can see the growth trend for capacitors, which we started to observe in 2018, has continued with capacitors firmly taking the top spot of the most reported part type in 2019, outpacing all ICs. From 2007-2017, capacitors constituted less than 3% of overall reported parts; however, in 2019, capacitors represented 17.34 % of reported parts, an increase from 14.1% in 2018.

The plots of the most commonly counterfeited components indicate two marked spikes in reported parts types. Capacitors, which we previously mentioned and Microprocessor ICs, which had a marked drop in 2018, now occupy the second spot constituting 12.05% of all reported parts in 2019.

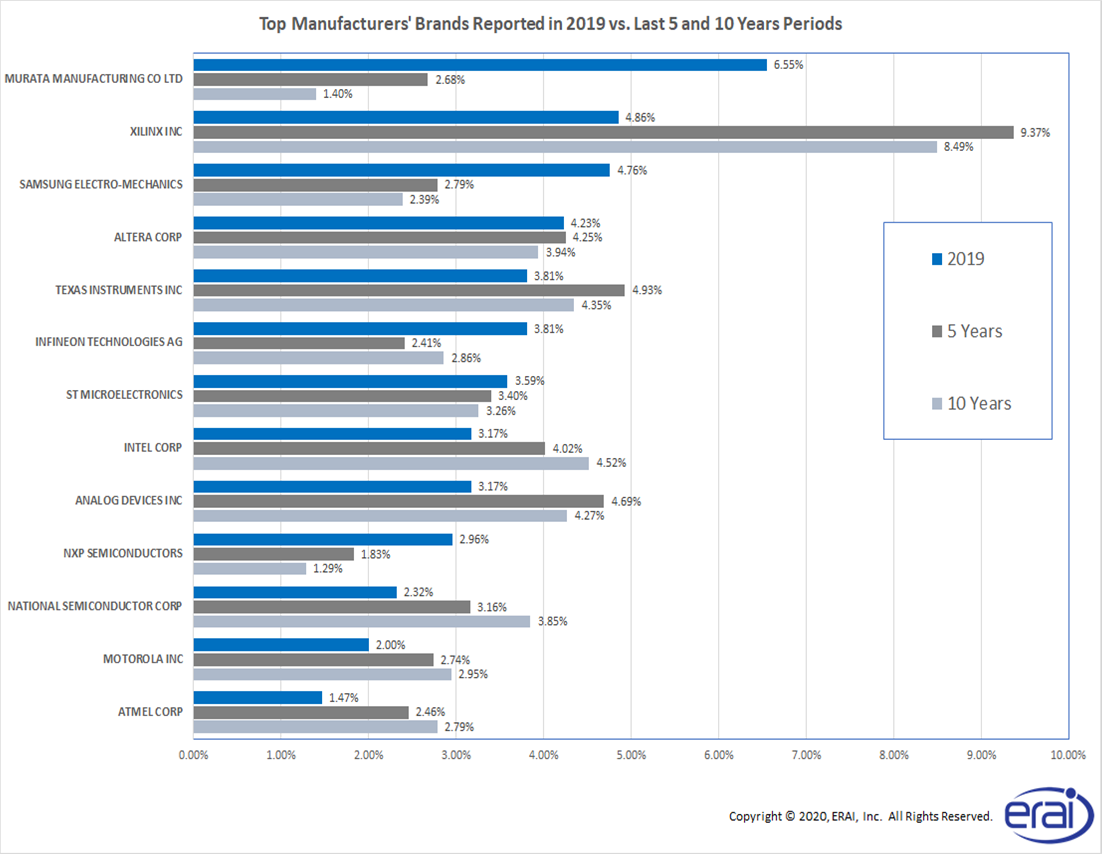

When examining the counterfeited brands of parts reported in 2019, we saw that for the first time in many years, Xilinx is no longer the most commonly targeted manufacturer brand. The most targeted brand for 2019 was Murata Manufacturing, which once again correlates to the capacitor shortages faced by the industry in 2018-2019.

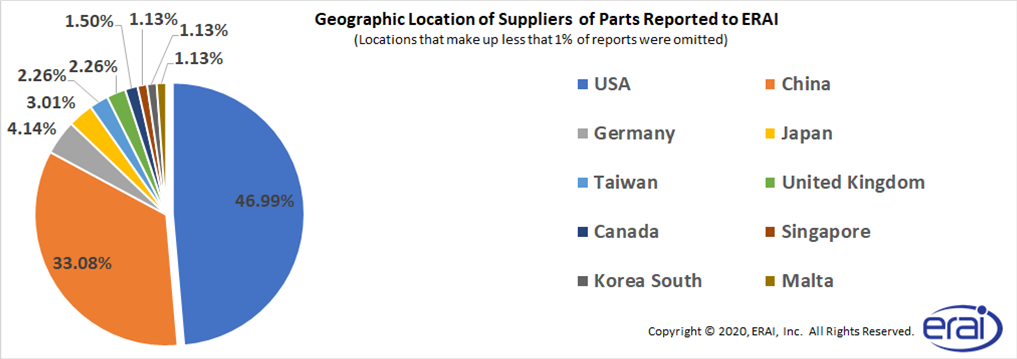

The next data set we examined was the geographic location of the suspect parts’ suppliers in cases where the supplier information was made available to ERAI. Consistent with past findings, the majority (46.9%) of part suppliers were located in the US. The volume of named Chinese suppliers increased from 22.09% in 2018 to 33.09% in 2019. Therefore, a total of 66.91% of parts reported to ERAI for being nonconforming, suspect counterfeit or counterfeit were sold by companies not located in China. These findings continue to be alarming and support the notion that a policy of simply not sourcing parts from China-based companies is not a sufficient strategy to avoid suspect/counterfeit parts.

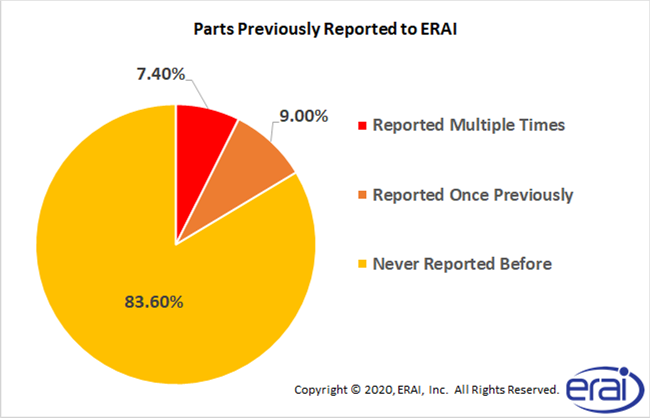

We further analyzed if any of the parts reported to ERAI in 2019 were also reported by ERAI in previous years. The results indicated that the majority of the parts reported in 2019 (83.60%) were parts that were never previously reported to ERAI, constituting an increase over the previous year when 74.03% of parts were never previously reported. Only 9% of parts were reported once previously and 7.4% were reported more than once before. This once again could be related to the spike of the counterfeit capacitors entering the market.

As always, we would like to thank those organizations that routinely share data with ERAI. If you have any questions or would like to see any statistical data that has not been covered in this report, please contact Damir Akhoundov at damir@erai.com.

SEE MORE BLOG ENTRIES

|