2017 ERAI Reported Parts Analysis

Damir Akhoundov

ERAI, Inc.

2017 ERAI Reported Parts Analysis

By: Damir Akhoundov

By: Damir Akhoundov

Please note: The data contained in this report for 2017 includes parts reported to ERAI from January 1, 2017 through December 20, 2017.

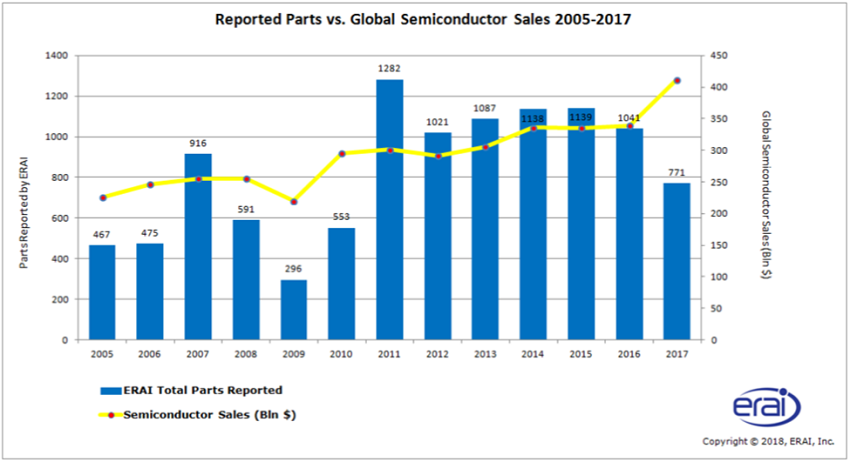

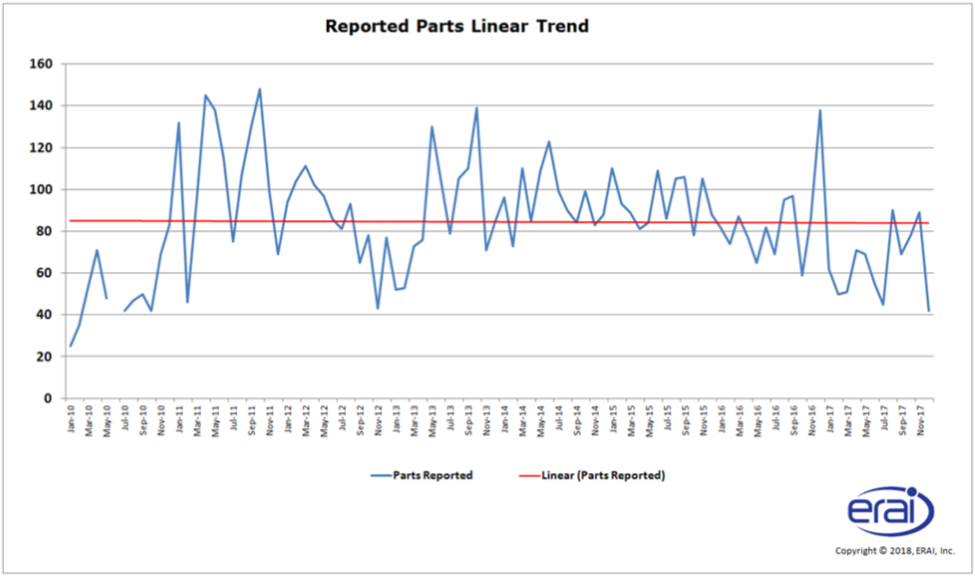

ERAI reported a total of 771 suspect counterfeit and nonconforming parts in 2017, which shows a marked decline from the last several years, despite an increase in global semiconductor sales. The decline, while interesting in itself, cannot be considered a change in the overall trend without taking into consideration data from future years. Factors that could cause this decline include better anti-counterfeiting procedures taken by organizations during the procurement process, more counterfeit parts being prevented from entering the supply chain through customs seizures and detentions, lack of enforcement of industry and government reporting requirements, and perhaps, some counterfeiters have reduced their activities due to improved and new counterfeit detection techniques. On the other hand, it may also indicate that more sophisticated counterfeiting techniques are resulting in fewer counterfeit parts being detected and, therefore, reported to ERAI. It will be interesting to see if this trend persists through 2018 or whether the decline was only temporary.

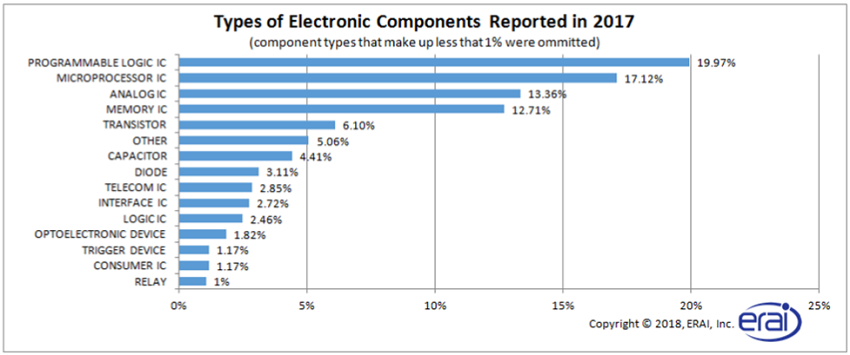

We then looked at the types of parts that were reported to ERAI in 2017 and compared it to last year’s data as well as the last 10 years’.

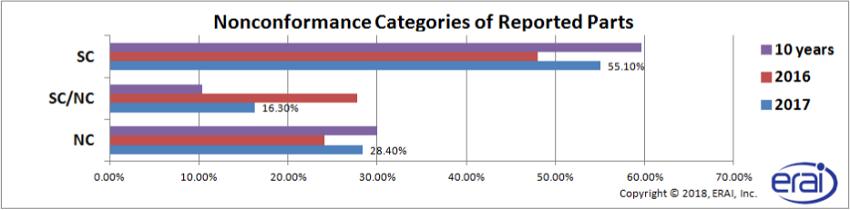

Nonconforming (NC) – A part that displays one or more nonconformance(s).

Suspect Counterfeit (SC) - A part that displays one or more nonconformance(s) and shows evidence of counterfeiting.

Suspect Counterfeit/Nonconforming (SC/NC) - A part that displays one or more nonconformance(s) and shows evidence it is a used part sold as new.

We observed that, as in the past, the number of parts considered "suspect counterfeit" (SC) remains high (55% in 2017 and 50% in 2016 and slightly higher overall in the last 10 years). The increase in parts classified as SC/NC in comparison to NC observed in 2016 did not continue to 2017 so we cannot conclude that it was the beginning of a trend related to more stringent regulations and standards that make parts previously designated as nonconforming to be marked as SC/NC.

The types of electronic components reported in 2017 largely followed the overall trend when the most commonly reported parts were integrated circuits:

- Programmable Logic IC

- Microprocessor IC

- Analog IC

- Memory IC

These four component types accounted for 63% of all parts reported.

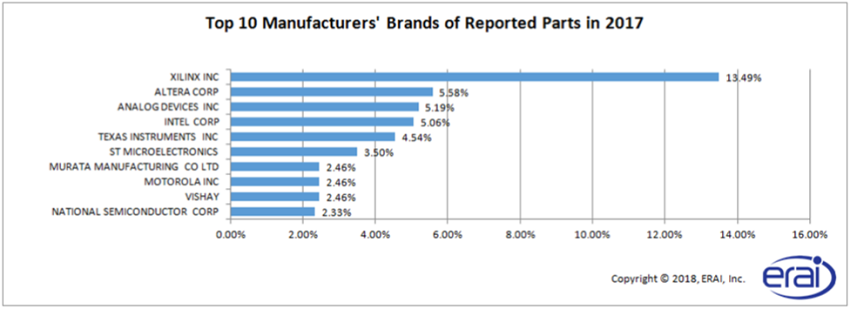

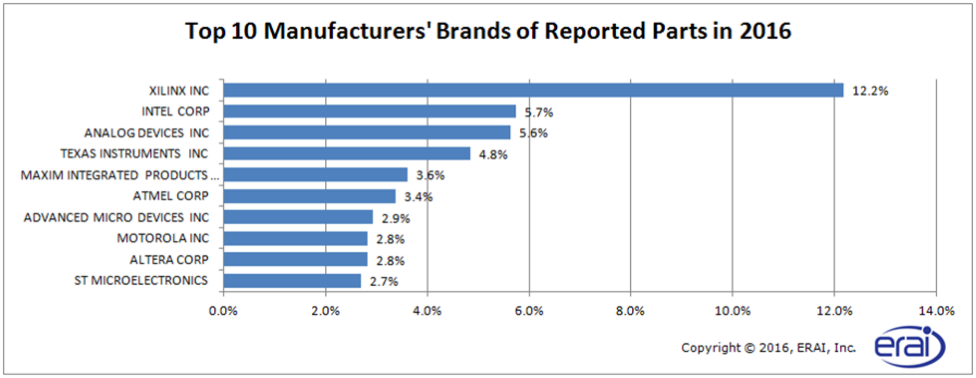

When examining the manufacturer’s brand marked on parts reported to ERAI, we once again see that Xilinx remains the brand most frequently targeted by counterfeiters and totals 13.49% of the parts reported to ERAI in 2017. The list of the manufacturers most frequently targeted by counterfeiters remains largely unchanged from previous years.

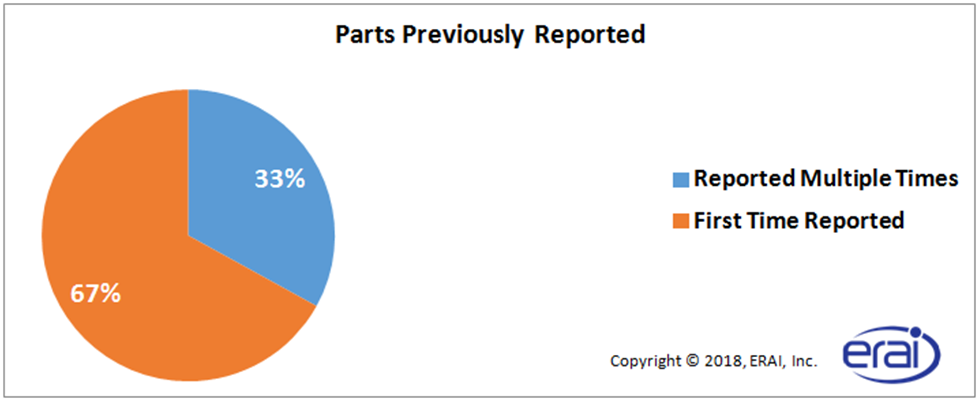

Analysis of parts previously reported by ERAI has revealed that although the number of parts that were reported more than once has increased (33% vs. 20.9% in 2016), the majority of the parts reported in 2017 (67%) were new occurrences that had not been reported to ERAI. Of the 33% of previously reported parts, almost half were reported two or more times, with five (5) parts reported ten or more times.

Suspect/counterfeit parts that have not been previously reported are constantly entering the electronic supply chain and the threat of encountering one of these parts remains very high. Reporting suspect/counterfeit parts is a crucial step in counterfeit prevention. We highly encourage everyone to report all suspicious parts to ERAI to ensure all organizations in the electronics industry are aware of potential threats.

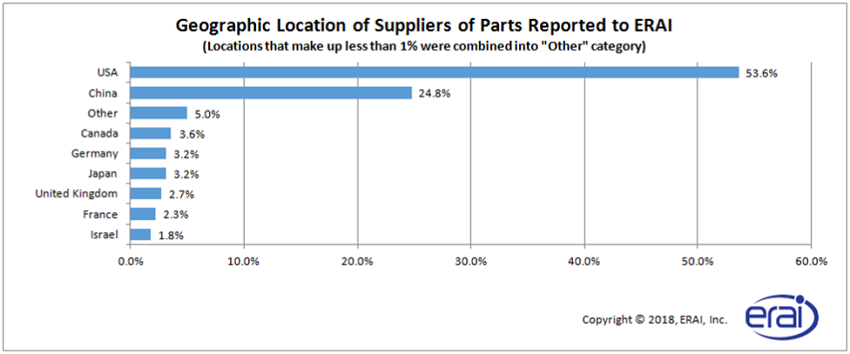

The next data set we examined was the geographic location of the suspect parts’ suppliers in cases where the supplier information was available. The data supports the previously noted fact that more than half of the known suppliers of suspect parts were located in the USA with China being a distant second. However, it should be taken into account that this statistic may not be a reliable measure as it only takes into consideration reports where the supplier was identified. One possibility that reporting entities do not provide the identity of their suppliers is because the supplier is located in a high risk area such as China and do not wish to disclose their purchasing strategies to ERAI. So if the identity of all suppliers would be known, the distribution graph may have looked quite different.

As always, we would like to thank those organizations that routinely share data with ERAI. If you have any questions or would like to see any statistical data that has not been covered in this report, please contact Damir Akhoundov at damir@erai.com and we will do our best to provide the information to you.

SEE MORE BLOG ENTRIES

|