Survey Results are in - Lack of Communication and Trust Negatively Impacting Relationship Between Industry and CBP

Anne-Liese Heinichen

ERAI, Inc.

At this year’s ERAI Executive Conference, Jorge Garcia, Deputy Assistant Director, Trade and Assistant Director, Enforcement, Electronics Center of Excellence and Expertise, discussed U.S. Customs and Border Protection’s Centers of Excellence and their role in detecting and seizing suspect counterfeit goods.

In 2014 CBP recorded imports to the US consisting of 11 million maritime containers, 10 million truck containers, 3 million rail containers, plus 250 million air cargo, postal and express consignment packagesi; a massive volume seemingly impossible to monitor. However, CBP has had successes in stemming the flow of counterfeit electronic parts. In fiscal year 2014, CBP Operation BeatsBody focusing on consumer electronics as well as integrated circuits resulted in 234 seizures totaling $1.5 million MSRPii. During FY2014 as a whole, 13% of total seizures representing a MSRP of $162,209,441.00 consisted of consumer electronics/partsiii.

It is becoming apparent from reports from Members that CBP is increasing enforcement efforts and more international shipments are being detained. CBP itself reports a 5% increase in seizures of semiconductors from FY2013 to FY2014iv.

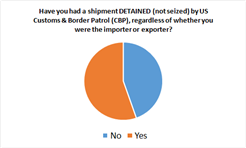

With this apparent increase in seizure and detention activity, we polled our Members to learn more about their experiences with CBP. Our survey found that approximately 55% of polled Members have had a shipment detained with the number of detained shipments averaging about 7 per participating Member.

We were also interested in learning how efficient CBP's process is and how close CBP manages to comply with the United States Code. With regard to notices of detention, USC Title 19 Section 1499 (c)(2) requires CBP to notify the importer of record or other party having an interest of a detainment "no later than 5 days, excluding weekends and holidays, after the decision to detain the merchandise is made"v . Of the Members who experienced a detained shipment, the majority state they never received a notice from CBP or they received a notice outside of the required 5-day timeframe. Many Members commented that they became aware of a detainment through their shipping carrier (e.g. UPS, FedEx) and thus did not receive a detainment notice.

USC Title 19 Section 1499 (c)(2) further mandates that the notice of detention should include, "(A) the initiation of the detention; (B) the specific reason for the detention; (C) the anticipated length of the detention; (D) the nature of the tests or inquiries to be conducted; and (E) the nature of any information which, if supplied to the Customs Service, may accelerate the disposition of the detention.vi" Polled Members stated that while most of the time a reason for detention was cited, a clearly stated anticipated length of detention, nature of tests to be conducted on the detained product and a description of information which could be provided to CBP to accelerate the disposition of the detention was not included more than half of the time. One Member even commented that the notice "did not include part number" [information] and several comments stated that the information provided was vague, not specific or simply not provided.

|

If you received a notice from CBP, did the notice include the following: |

YES |

NO |

|

Specific reason for detention |

61.29% |

38.71% |

|

Anticipated length of detention |

9.68% |

90.32% |

|

Nature of tests to be conducted to determine product's authenticity |

6.45% |

93.55% |

|

Description of information which could be provided to CBP to accelerate the disposition of the detention |

29.03% |

70.97% |

When questioned if they had provided CBP with documentation (e.g. test report, supply chain traceability documentation) for a detained shipment in an effort to expedite a resolution, most Members stated they had supplied documentation while a minority of the member base was not aware that they could provide documentation or never did so. Of the Members who supplied documentation, 50% believe that the documentation provided altered the outcome. Members reported providing test reports, certifications (e.g. FCC, FDA) and traceability showing parts were purchased from a franchised distributor. The other half of Members stating they supplied documentation believe that the information did not alter the outcome with several Members commenting that CBP was either unresponsive and/or Members were unable to determine an appropriate CBP contact with whom to discuss their case.

USC Title 19 Section 1499 (c)(3) testing results mandates:

Upon request by the importer or other party having an interest in detained merchandise, the Customs Service shall provide the party with copies of the results of any testing conducted by the Customs Service on the merchandise and a description of the testing procedures and methodologies (unless such procedures or methodologies are proprietary to the holder of a copyright or patent or were developed by the Customs Service for enforcement purposes). The results and test description shall be in sufficient detail to permit the duplication and analysis of the testing and the results vii.

In our survey, most Members were not aware that CBP could provide test results, while the one-third of Members that did request test results never received a report. Only one Member reported receiving a test report from CBP. The Member stated that the report was only provided to them after having lawyers file a Freedom of Information Act request and, "when we did, it was redacted to such an extreme degree that there was no relevant information left. No test reports, no fact, no data, no conclusions, no summary of why the parts were deemed counterfeit" .

Seventy-five (75) percent of Members polled were unaware that USC Title 19 Section 1499 (b)(3) permits the importer of record to request that CBP release to them "a representative sample of the merchandise for testing, at the expense of the importer, by a laboratory accredited under paragraph (1)".viii Although this regulation only allows samples to be sent to either a CBP-run laboratory or a private laboratory accredited by CBP, it does give importers more power to refute allegations of counterfeit marks.

Of the 25% who were aware, nine (9) reported requesting samples; however not a single Member has received a sample from CBP.

Forty-four percent of Members report that they have had a shipment seized by CBP with an average number of seizures as two per Member. Almost half of detained shipments reported in our survey were released within 30 days. According to USC Title 19 Section 133.21, CBP may detain shipments for " a period of up to thirty days from the date on which the merchandise is presented for examination [and] may be extended for up to an additional thirty days for good cause shown by the importer ix." However, the survey showed that almost a quarter of reported shipments were reported as being detained for 60 days or longer.

Overall, 58% of Members surveyed feel that they have not seen a change in the number of detainment and/or seizure activity; 34% believe they are seeing increased activity and only 7% believe they are seeing decreased activity.

When asked to rate CBP’s responsiveness and helpfulness when contacted regarding a seized or detained shipment, 11% stated they were unable to speak to anyone at CBP and/or never received a response to their queries. Only 11% of respondents rated CBP’s customer service as good or excellent. Dissatisfaction with the detainment process even prompted one non-US-based Member to report that they now use a carrier whose routes specifically bypass US soil to avoid delays caused by US CBP detainments on in-transit/transfer flights.

When prompted for comments, Members had three main complaints: unresponsiveness on behalf of CBP, mishandling of goods and delays causing a hindrance of free trade. One Member stated, "when we have received parts back that were detained, they were repacked carelessly and damaged." Another Member stated, "they did not re-band the trays they opened and returned the parts out of the trays and damaged." Another Member added, "even boxes that are just inspected, come in a mess. They don't RE VACUUM SEAL MSL devices; they don't reband or retape trays, or repackage reels correctly…numerous times we have received in damaged parts and parts rattling around, loose in the box, damaged of course." With regard to delays, Members commented, "we have markedly decreased imports from ALL sources- it is simply not worth the risk anymore. CBP practices have significantly hurt our bottom line and hindered free trade" , "they are messing up our entire business model" , and "there is a deliberate attempt to keep us in the dark...the whole process is very baffling."

Steps you can take to protect yourself:

-

Have the product tested prior to importation and include copies of test documentation in the shipment box.

-

Have your supplier include documents showing the traceability of the parts in the shipment box, if available.

-

Acknowledge and respond to CBP detention notices.

-

Provide CBP with documentation such as test reports, supply chain traceability documentation, supplier risk assessments, etc. in an effort to expedite a resolution.

-

If product is detained, request copies of both CBP’s test reports and any information in the shipment’s file, which is generally stored at the port of entry where the product was screened. If CBP does not provide these documents at your request, you may be able to file a Freedom of Information Act request for the information.

-

If your product is detained, also request samples for further testing and provide test results to CBP. Beginning October 19, 2015, importers will have more power to request samples under revised regulation 19 C.F.R. § 133.21(d), which allows CBP to give the importers unredacted photographs, images, and samples of the suspect product at any time after it is presented for CBP inspection.

Supplemental Note:

To address concerns addressed by importers and trademark holders, on September 18, 2015, The Department of Homeland Security issued a final rule providing changes to CBP regulations pertaining to suspect counterfeit goods. This final rule becomes effective as of October 19, 2015. Please note that the final rule was issued after the conclusion of the ERAI survey.

For importers, the changes specifically require CBP to release to the importer "unredacted photographs, images, or an unredacted sample of imported merchandise suspected of bearing a counterfeit mark at any time after the merchandise is presented to CBP for examination." x Importers will be required to return the samples to CBP at their request or at the end of an inspection. CBP’s intention is that this will assist importers in providing a more thorough response when they are notified that a shipment has been detained. If the importer does not provide a response within the allotted seven-day time period, CBP may then disclose information to the trademark holder.

The changes also allow CBP to reveal information that appears on merchandise and packaging to the IP holder that would otherwise be protected by the Trade Secrets Act. If merchandise is seized, CBP will now also disclose the following to the trademark holder within 30 days from the date of seizure: date of importation; port of entry; merchandise description; quantity; country of origin; name and address of manufacturer; name and address of the exporter and the name and address of the importer.

Special thanks to Brett W. Johnson and Sarah Delaney of Snell & Wilmer L.L.P. (www.swlaw.com) for their assistance with this article.

iJorge A. Garcia, U.S. Customs and Border Protection, ERAI Executive Conference 2015 Presentation "United States Customs and Border Protection, Center of Excellence and Expertise for Electronics", https://www.erai.com/customuploads/conference/2015/downloads/Customs Center of Excellence Garcia.pdf

iiIntellectual Property Rights Seizure Statistics Fiscal Year 2014, U.S. Department of Homeland Security, https://www.cbp.gov/sites/default/files/documents/2014 IPR Stats.pdf

iiiIntellectual Property Rights Seizure Statistics Fiscal Year 2014, U.S. Department of Homeland Security, https://www.cbp.gov/sites/default/files/documents/2014 IPR Stats.pdf

ivIntellectual Property Rights Seizure Statistics Fiscal Year 2014, U.S. Department of Homeland Security, https://www.cbp.gov/sites/default/files/documents/2014 IPR Stats.pdf

v19 U.S.C. § 1499, https://www.gpo.gov/fdsys/granule/USCODE-2011-title19/USCODE-2011-title19-chap4-subtitleIII-partIII-sec1499

vi19 U.S.C. § 1499, https://www.gpo.gov/fdsys/granule/USCODE-2011-title19/USCODE-2011-title19-chap4-subtitleIII-partIII-sec1499

vii19 U.S.C. § 1499, https://www.gpo.gov/fdsys/granule/USCODE-2011-title19/USCODE-2011-title19-chap4-subtitleIII-partIII-sec1499

viii19 U.S.C. § 1499, https://www.gpo.gov/fdsys/granule/USCODE-2011-title19/USCODE-2011-title19-chap4-subtitleIII-partIII-sec1499

ix19 U.S.C. § 133.21, https://www.gpo.gov/fdsys/pkg/CFR-2010-title19-vol1/pdf/CFR-2010-title19-vol1-sec133-22.pdf

xFederal Register, Vol. 80, No, 181, September 18, 2015, Rules and Regulations, https://www.federalregister.gov/articles/2015/09/18/2015-23543/disclosure-of-information-for-certain-intellectual-property-rights-enforced-at-the-border

SEE MORE BLOG ENTRIES

|

|