Authentic Parts Classified as Counterfeit and Seized by CBP Highlight Financial Risks for Importers and Exporters

Kristal Snider

ERAI, Inc

Authentic Parts Classified as

Countfeit & Seized by CBP Highlight Financial Risks for

Importers and Exporters

By: Kristal Snider By: Kristal Snider

For more than a year, beginning in

January 2014, a distributor in the U.S. placed eleven (11) orders for

more than 16,000 pieces of Texas Instruments part number

TMS320VC5416ZGU160 from an Israeli distributor and subcontractor

servicing the defense, medical and communications industries in Israel.

No nonconformities were ever detected during the inspection of these

shipments. No complaints or concerns were raised by the U.S.

distributor’s end user and sole recipient of all prior shipments. For

all intents and purposes, the Israeli and American companies enjoyed a

mutually beneficial relationship and no one, including the end user, had

reason to suspect the goods in question were anything other than

genuine Texas Instruments parts. That is, until May 4, 2015, when one of

the final three scheduled deliveries containing 4,000 pieces of the

aforementioned part worth $46,435.00 was detained and subsequently

seized by CBP under Title 19, United States Code, Section (USC) 1595a(C)

for bearing a counterfeit trademark. The initial detention notice

triggered a flurry of activity that would slow to a crawl, then drag on

for ten costly, labor-intensive months and ultimately conclude with the

release of the goods. This distributor’s experience captures the

significance of goods being correctly classified as authentic or

counterfeit, highlights the importance of an open line of communication

between CBP and industry, and personifies the struggles business owners

are facing that could result in substantial financial

loss.

The

Initial Detention Notice

It was while checking the delivery status of the

shipment using Federal Express’ online tracking system that the U.S.

distributor first learned the parts they had paid for wire transfer in

advance had been held by U.S. Customs and Border Protection (CBP) and,

shortly thereafter, on May 5, 2015, the standard “Detention Notice and

Custody Receipt for Detained Property” was received. The distributor was

given seven days to provide evidence to demonstrate the authenticity of

the parts. The Israeli supplier was asked to provide supply chain

traceability to assist in this process but subsequently refused to

cooperate. A representative of the Israeli supplier later revealed the

reason they were not able to provide this documentation is that doing so

would have jeopardized their relationship with their supplier and

supplier’s relationship with Texas Instruments due to the fact these

parts were allegedly sold in violation of the supplier’s distribution

agreement with Texas Instruments.

Sans the necessary supply chain traceability, the U.S.

distributor then contacted its customer, the recipient of all prior

shipments, to make them aware of the situation and to see if they could

return samples from past shipments for reevaluation and comparison to a

known good sample. This effort was successful; the U.S. distributor was

confident they could produce the evidence necessary to prove the parts

being detained were authentic.

Part Comparison and

Findings

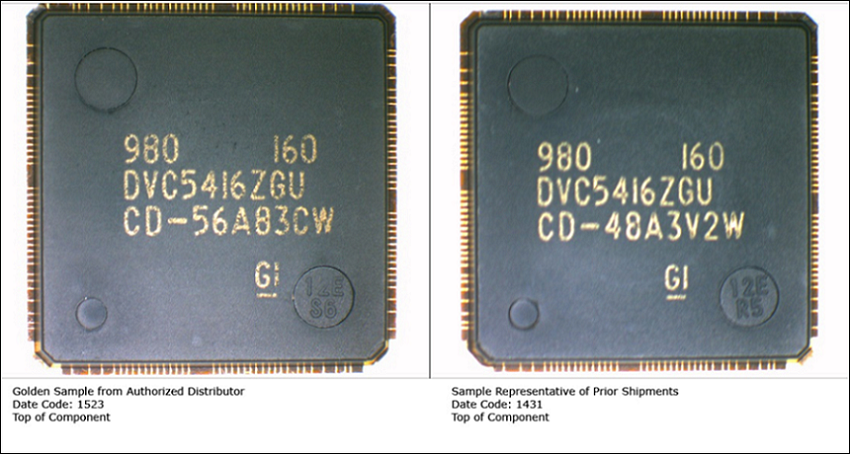

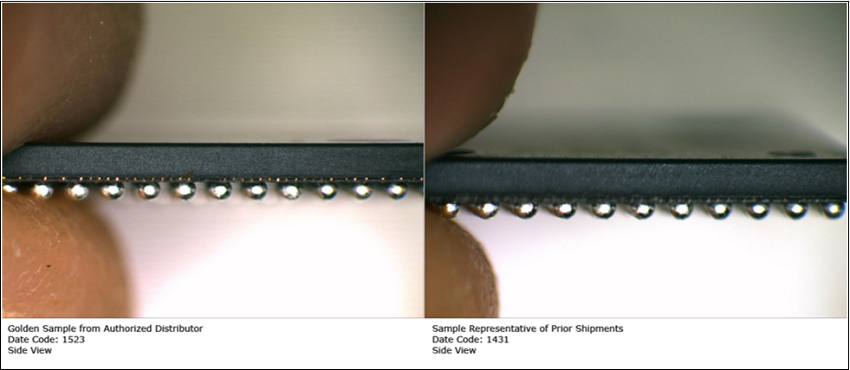

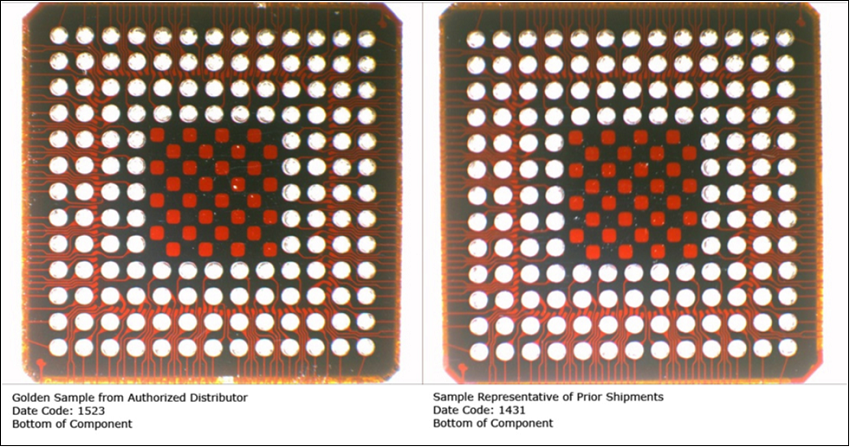

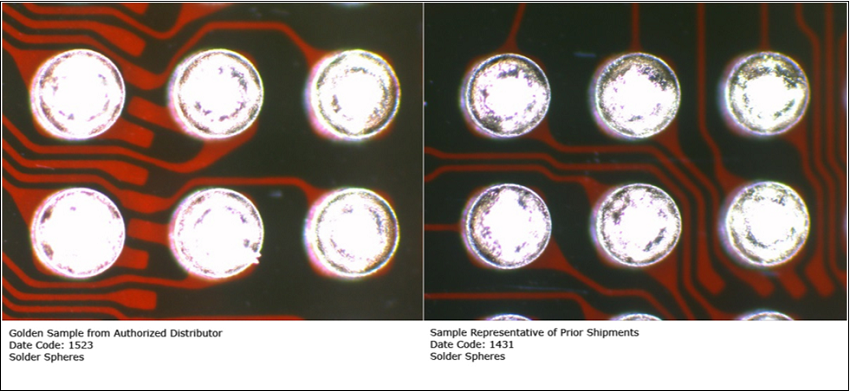

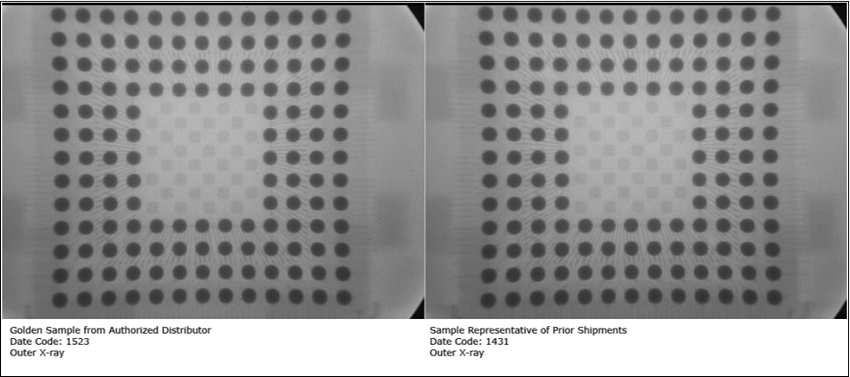

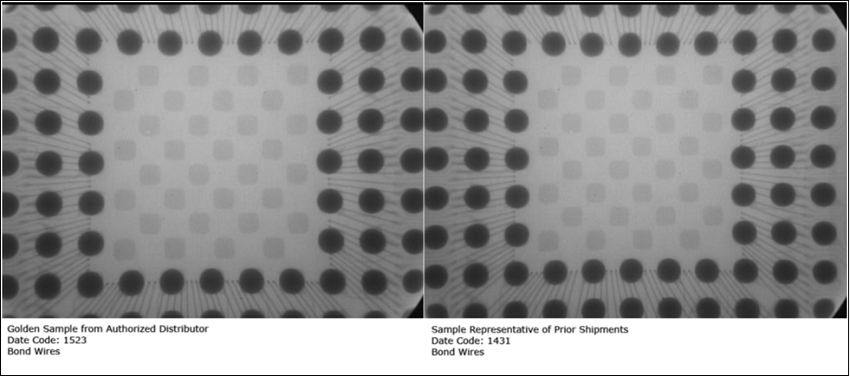

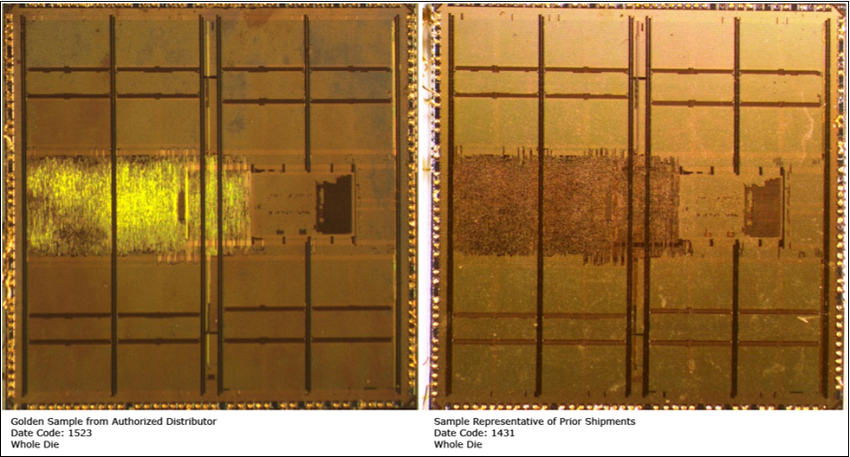

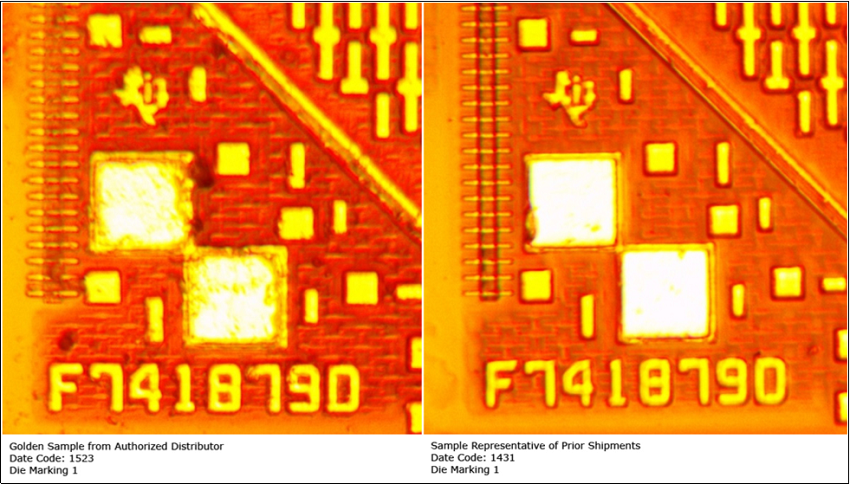

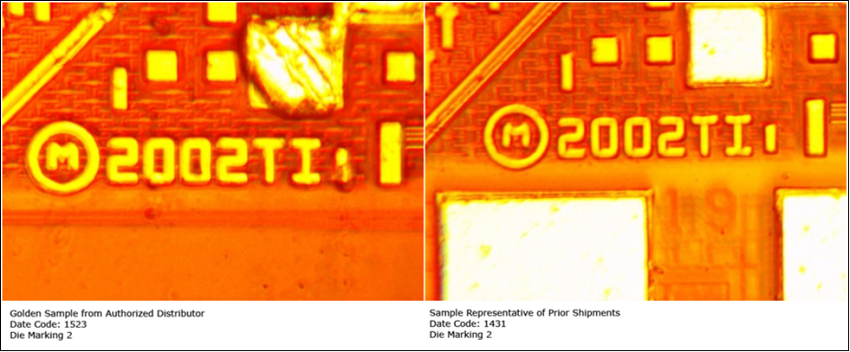

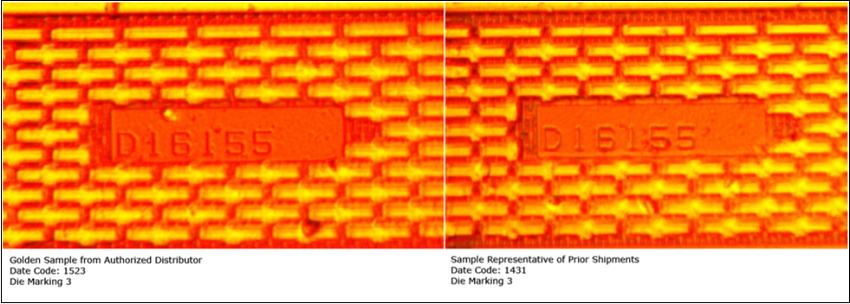

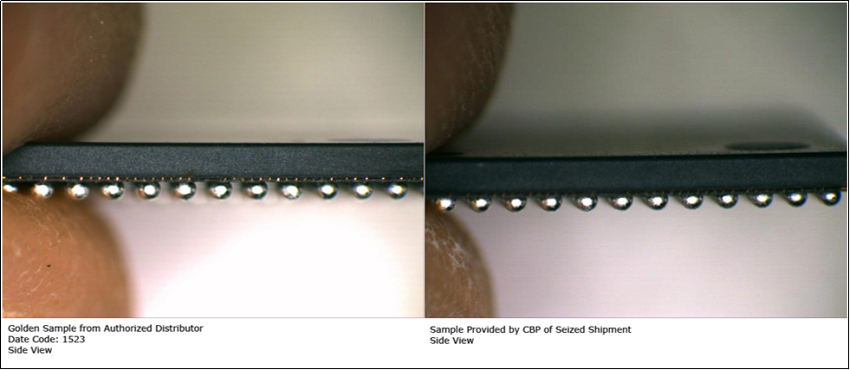

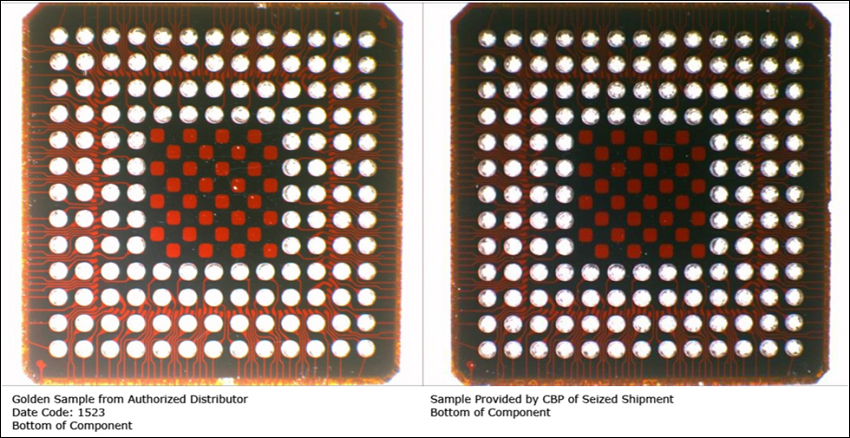

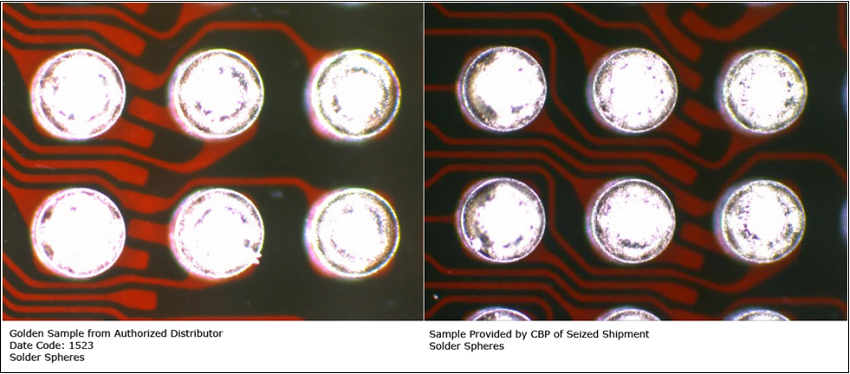

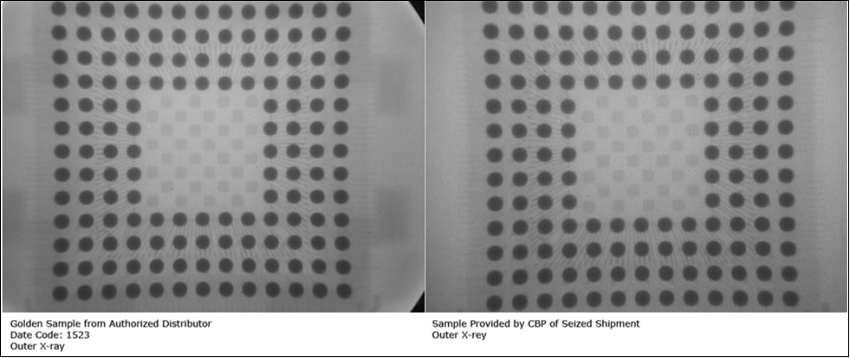

The U.S. distributor purchased three (3) golden samples

from an authorized TI distributor in the U.S. and compared these parts

to samples they were able to retrieve from their customer that were

representative of prior shipments. Using various inspection methods, the

parts were examined both externally and internally and no evidence of

tampering was observed. The general appearance, physical construction,

and die markings are consistent. The results of the comparison analysis

were presented to CBP but did not result in the release of the

goods.

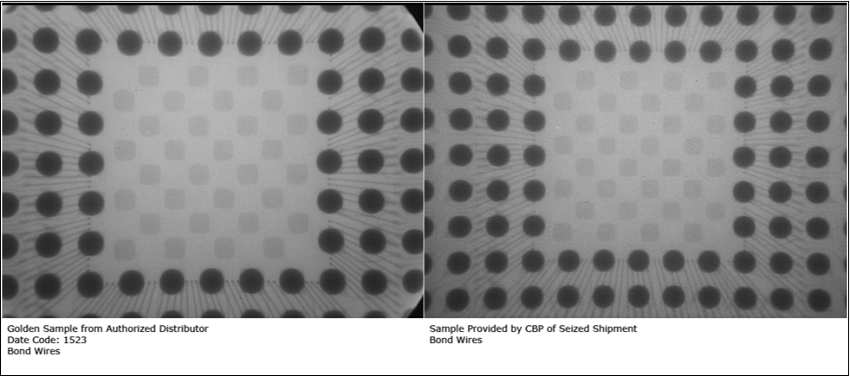

Photo Comparison of Known Golden Sample vs

Samples Representative of Prior Shipments

Notice of Seizure

On August 25, 2015, after receiving

the above noted findings twenty days earlier, the U.S. distributor

received formal notification from CBP that the goods in question had

been seized for bearing a counterfeit trademark. The appraised domestic

value of the property was assessed at $99,000.00. The U.S. distributor

immediately exercised its right to “petition” the seizure and sought

remission of the forfeiture in accordance with CBP’s “Election of

Proceedings”.

The Petition Process

The U.S. distributor’s attorney

initiated contact with CBP on September 22, 2015 and again on October

12, 2015 in an effort to obtain two (2) samples of the seized parts for

inspection and comparison to the known golden sample and representative

sample previously analyzed. The release of the samples was finally

granted on or about October 27, 2015.

On November 4, 2015 the U.S.

distributor received a cease and desist letter from Texas Instruments

which included, but is not limited to, the following

statements:

“TI

learned that you have been importing counterfeit TI semiconductor

products.”

“As you

are no doubt aware, obtaining TI products from sources that are not

expressly authorized by TI presents a substantial risk that such

products are counterfeit. Indicators that a seller may be offering

counterfeit products include unusually low prices, prior seizures of

counterfeit goods by Customs officials, and poor or missing chain of

custody documentation to TI or an authorized source.”

“We hereby demand that you

immediately cease and desist any importation, offers to sell, sales, or

other transactions involving counterfeit TI

products.”

The U.S. distributor was given five (5) business days to

confirm they agreed to discontinue the purchase and sale of counterfeit

TI products; they responded to TI, as they had responded to CBP,

asserting that the parts are original and not

counterfeit.

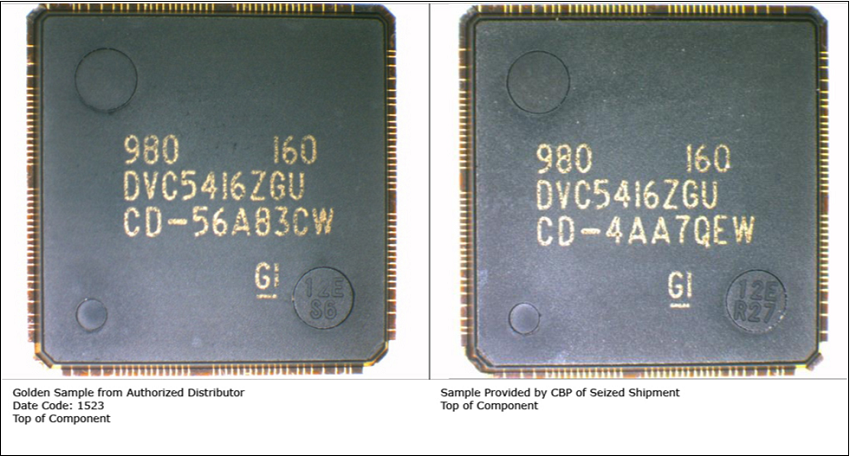

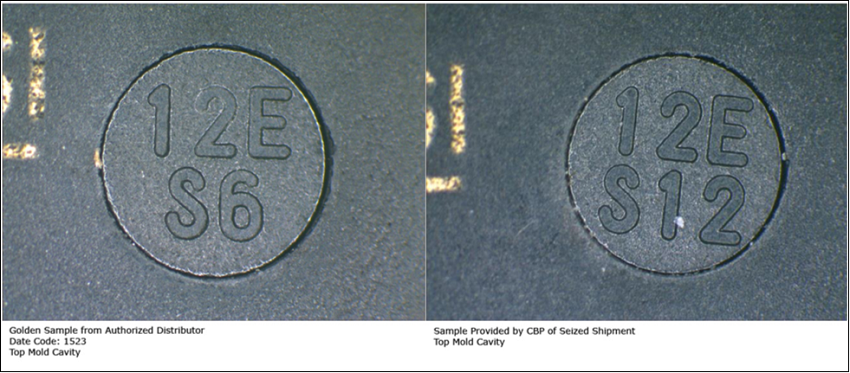

On

November 17, 2015, more than six months after receiving the original

notice of detention, the U.S. distributor was finally able to compare

the inspection results of the seized parts against the previous

comparison involving the known golden sample and representative sample

provided by the U.S. distributor’s customer: the seized parts were

consistent with the other two lots.

Photo Comparison of Known

Gold Sample vs Samples Seized by CBP

In addition to the results of the part comparison and

after tremendous pressure, on December 31, 2015, the Israeli supplier

provided a copy of a packing list as evidence the goods in question were

purchased from Arrow Seed (Hong Kong) Limited, a division of Arrow

Electronics, Inc. and an authorized Texas Instruments distributor. While

the quantity and dates align with the goods purchased by the U.S.

distributor, the identity of the recipient and the ship to address had

been redacted. This new information, albeit not complete, was also

submitted to CBP for consideration.

Notice of Release from

CBP

On

January 25, 2016 the U.S. distributor received written notification from

CBP the goods would be released after concluding the burden of proof

had been met to support its assertion that the goods are not

counterfeit. Prior to initiating the return of the shipment, CBP

required the U.S. distributor to sign, notarize and return a “Hold

Harmless Agreement” releasing and forever discharging the United States

and its officers from any and all action, suits, lawsuits, proceedings,

costs, expenses, debts, dues, contracts, judgments, damages, claims

and/or demands whatsoever in connection with the detention, seizure

and/or release of the goods.

On March 1, 2016, the partially damaged and improperly

packaged goods were delivered to the U.S. distributor’s facility marking

an end to this lengthy and costly ordeal.

Financial Risks for

Importers

As briefly mentioned early on, the payment terms for all

orders referenced herein were wire transfer in advance. To offset their

financial risk, the U.S. distributor’s purchase order contract

specifically designated “FOB Destination” in its shipping terms which

means the Israeli supplier was responsible for the goods until they

reached the U.S. distributor’s location. Despite the fact these terms

were in the agreement, the Israeli supplier refused to refund the U.S.

distributor’s advanced payment totaling $46,435.00 when the goods were

detained and subsequently seized. Had the U.S. distributor not been

successful in meeting the burden of proof that the goods were not

counterfeit and securing their release from CBP, it is unlikely they

would have received reimbursement without incurring additional legal

expenses.

Conversely, this exporter and all others face equal risks

and must openly communicate with international trading partners

relative to the availability of supply chain traceability and testing,

inspection and counterfeit risk mitigation requirements prior to

shipping goods. Had the parts been shipped on an open account, it is

unlikely the U.S. distributor would have fought as hard as it did to

secure the release of the goods and the Israeli supplier would have had

no hope of retrieving the goods or receiving payment for goods that were

not delivered in accordance with the purchase order contract or not at

all.

Caveat Emptor

U.S. citizens and business owners

have no constitutional right to import or conduct international trade.

Importers must constantly measure risk and be on the lookout for

emerging risks such as goods being damaged, detained or seized by

CBP.

Conclusion

There is no question in my mind

that CBP is doing what it can to prevent counterfeit electronic parts

from entering the supply chain and is doing so while facing tremendous

challenges and pressure from brand owners and others. The takeaway from

this article should not be that CBP is doing a poor job; it should be

that industry and CBP desperately need a more open line of communication

and must work together to educate agents and policy

makers.

When

authentic parts are inadvertently removed from the supply chain, or are

damaged due to improper handling and repackaging, an opportunity for a

counterfeit part to enter in their place is created.

SEE MORE BLOG ENTRIES

|